‼️The tax filing season is upon us and today, we are going to shine some light on Form E! We will be sharing about:

-

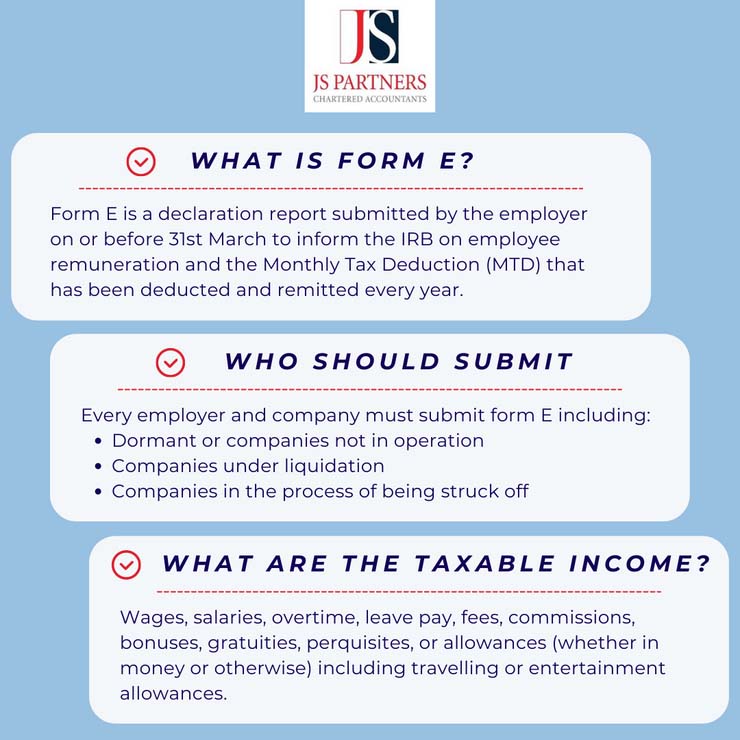

What is Form E

-

Who Should Submit Form E

-

What Are the Taxable Income for Monthly Tax Deduction (MTD)

-

List of Benefits in Kind That Must Be Reported in Form E & EA (CP8D)

All Malaysian business regardless of whether it’s a large, medium or small company is required to submit a Form E to the Inland Revenue Board (IRB) via e-Filling by the end of this month – 31st March 2021 🗓️ Now, what happens if you fail to submit the form within the stipulated filing date? The penalty ranges from RM200 to RM20,000; imprisonment for a term not exceeding 6 months; or both! 🚨

Let’s avoid that, shall we? JS Partners can help with your tax filling and submissions. 📲 Contact us via https://wa.me/60122192492 to discuss further 😊

Facebook: https://www.facebook.com/JS-Partners-890552254344978/

LinkedIn: https://www.linkedin.com/company/js-partners/

Youtube: https://www.youtube.com/channel/UCZMn8yFjcsuu2PlnX8F1GNg