Did you know that the collection of the tourism tax now lies within the responsibility of the online booking platforms? 🔑🏨

As part of Malaysia’s 2021 Budget, an initiative to impose tourism tax on bookings made via online booking platforms such as Agoda, Trivago and Booking.com was introduced. Currently, the accommodation operator itself is in charge of charging and collecting the tourism tax BUT the Government has amended the Tourism Tax Act 2017 to place a duty on online booking platforms to collect and remit tourism tax to the Government – effective from 1 July 2021 onwards.

Now, we know that this can be pretty stressful and some of you are probably like “I don’t even know what to start with”. Don’t worry, we have highlighted some key points to help in the preparation for the implementation of this new duty.

It is important to note that online booking platforms who fail to apply for registration for tourism tax may find themselves automatically registered for the tax as the amendments grant the Director General of Customs the power to register online booking platforms where information becomes known that there is a liability to be registered.

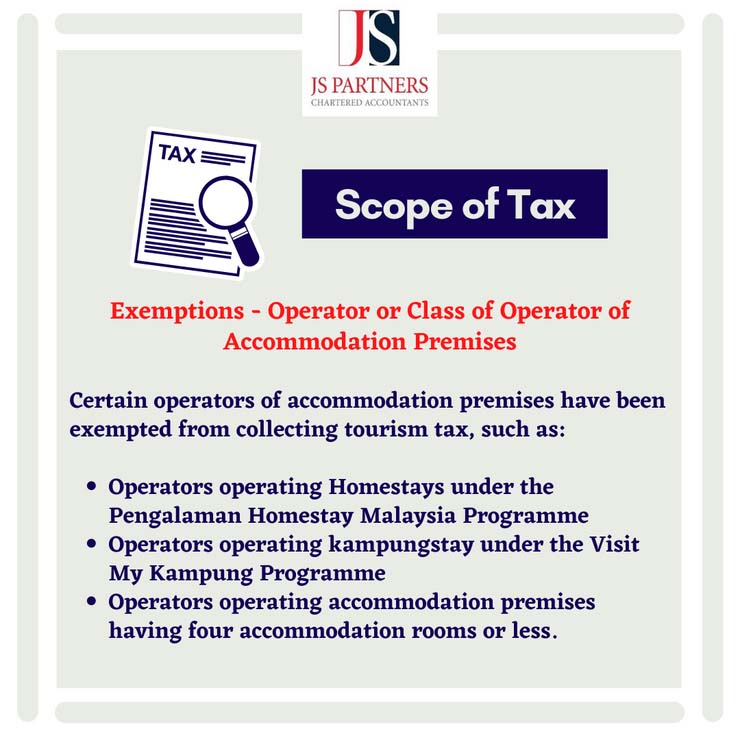

It is unclear at this stage whether the same exemption would be extended to online booking platforms providing the service of booking these types of accommodation premises. However, we expect similar exemptions would be made available to bookings of these accommodation premises made through online booking platforms to achieve a level playing field.

It is unclear at this stage whether the same exemption would be extended to online booking platforms providing the service of booking these types of accommodation premises. However, we expect similar exemptions would be made available to bookings of these accommodation premises made through online booking platforms to achieve a level playing field.

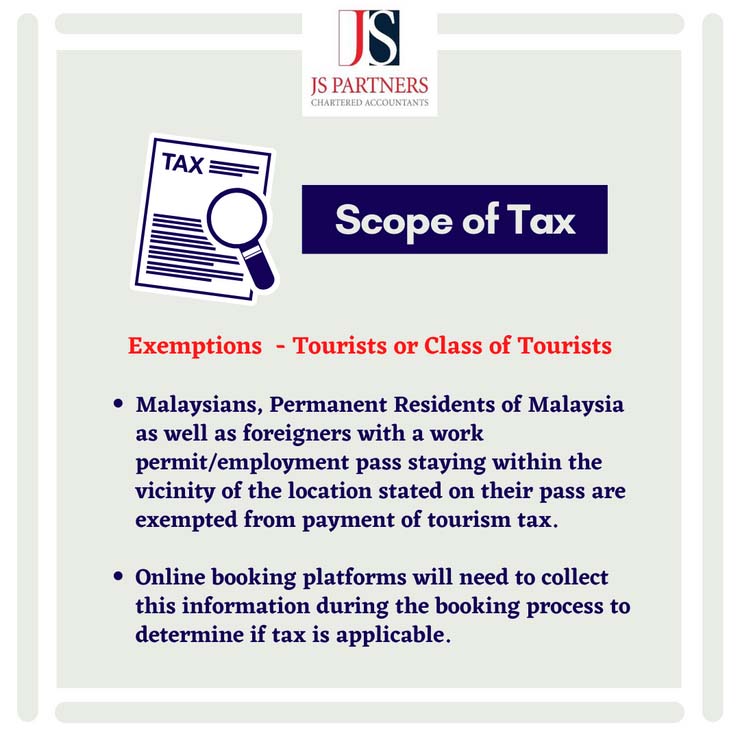

Other matters such as the confidentiality and security of information collected and the type of data (such as identity card no. / passport no.) required to be collected and stored for tourism tax purposes should also be considered when online booking platforms gear themselves up towards the implementation of tourism tax

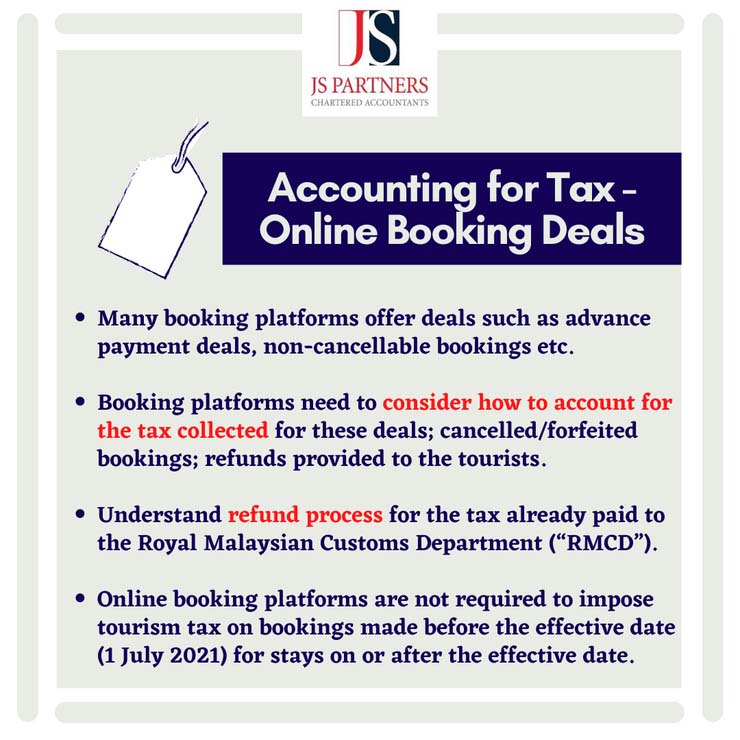

The amendments also provide that online booking platforms are not required to impose tourism tax on bookings made before the effective date (intended to be on 1 July 2021) for stays on or after the effective date.

You can download the PDF file and save for future reference (or even share it with those who would benefit from this info) 😉

As always, we suggest online booking platforms to start planning in advance to ensure everything will be up and running as expected. 📲 If you need any assistance or further clarification in regards to tourism tax and its implementation, feel free to reach out to us via https://wa.me/60122192492. We would be happy to help you 😊

Facebook: https://www.facebook.com/JS-Partners-890552254344978/

LinkedIn: https://www.linkedin.com/company/js-partners/

Youtube: https://www.youtube.com/channel/UCZMn8yFjcsuu2PlnX8F1GNg