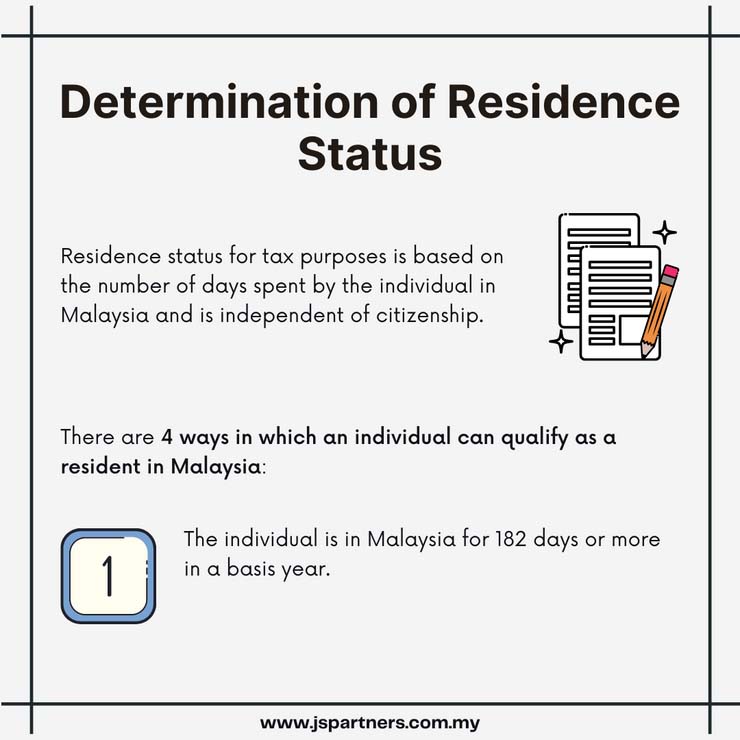

A couple of weeks ago, I had a client asking about tax residency status for a few of the company’s employees. This would of course depend on the length of their stay in Malaysia 🇲🇾

Why is it important to determine tax residency status? 🤔

📌 It determines whether or not the employee can claim personal reliefs, tax rebates, and enjoy the benefit of graduated tax rates.

*Non-residence is taxed at a rate of 30% without being eligible to enjoy any tax reliefs/rebates, whereas a resident is eligible to tiered rates from 0% to 30% and reliefs/rebates.

📌 It affects their taxes at home country, including any credits and offsets available under a tax treaty.

Need help with the intricacies of tax status, withholding and running payroll? Reach out to us via WhatsApp https://wa.me/60143248237 and our team will be in touch.

Facebook: https://www.facebook.com/JS-Partners-890552254344978/

LinkedIn: https://www.linkedin.com/company/js-partners/