A few years ago, there was a widespread claim on tax evasion by doctors and audits by LHDN 😨 It was mainly due to the formation of private limited companies by doctors – which is entirely legal. But that triggers a whole other dilemma – should the income be assessed under the individual or the company? 🤔

🧑🏻⚕️ If you are a doctor, here’s a guideline on tax treatment for medical practitioner in private hospitals 🏥

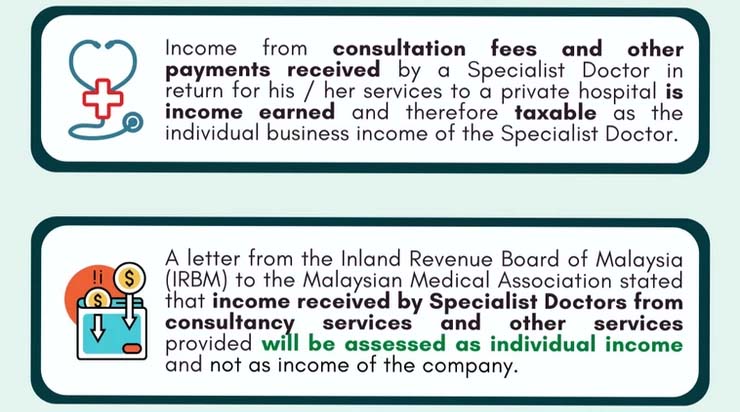

INCOME TO BE ASSESSED UNDER THE INDIVIDUAL

If a Specialist Doctor sets up a company and enters into an agreement with a private hospital to provide specialist services to patients, the private hospital will pay the consultation fee and any other form of payment to the Company. The Company will then pay the salary to the doctor. *The principle of tax treatment is the same regardless whether the agreement entered into with a private hospital is in the name of the Specialist Doctor or the Company.

If several Specialist Doctors establish a Company and enter into an agreement with a private hospital to provide specialist services to patients, consultation fees and other fees received from such private hospital are still considered as individual incomeof Specialist Physicians.

In situations below where a doctor owns a Specialist Clinic located in a private hospital premises, consultancy fees and any other forms of payment received are treated as income of the doctor.

-

Patients come to private hospitals for treatment. The patient was referred to a Specialist Doctor who owns a clinic at the hospital to receive appropriate treatment. After the treatment, the patient obtains the medicine from the hospital pharmacy and makes the payment at the hospital payment counter.

-

Patient comes directly to the Specialist Clinic to seek treatment from specialist doctor and patient requires surgery or further treatment using hospital facilities such as operating theaters or others.

There are doctors who also conduct business in medical related fields such as selling medical products, pharmacies and health aids other than carrying out the profession as Specialist Doctors in private hospitals. In this situation, the doctor has two different sources of business income.

Consultancy fees and other fees received from private hospitals are treated as individual income while the income received from the business of selling goods must be reported as business income.

INCOME TO BE ASSESSED UNDER THE COMPANY

In certain circumstances, there are income received by a Specialist Physician that may be assessed under the Company.

If a doctor owns a Specialist Clinic in a private hospital premises. Patients come directly to receive specialist treatment from the clinic without being referred by a private hospital. The doctor does not use any private hospital facilities in carrying out treatment to patients. Therefore, the income received by the doctor is the income of the Company.

If the Specialist Clinic is not in the premises of a private hospital and the services provided to patients also do not involve any private hospital, then the consultation fees and other fees received from patients or clients to the Specialist Clinic is taxable as income of the Company.

Don’t want to be burdened by this tax mess? Reach out to us via WhatsApp https://wa.me/60143248237 and let us help you.

Facebook: https://www.facebook.com/JS-Partners-890552254344978/

LinkedIn: https://www.linkedin.com/company/js-partners/