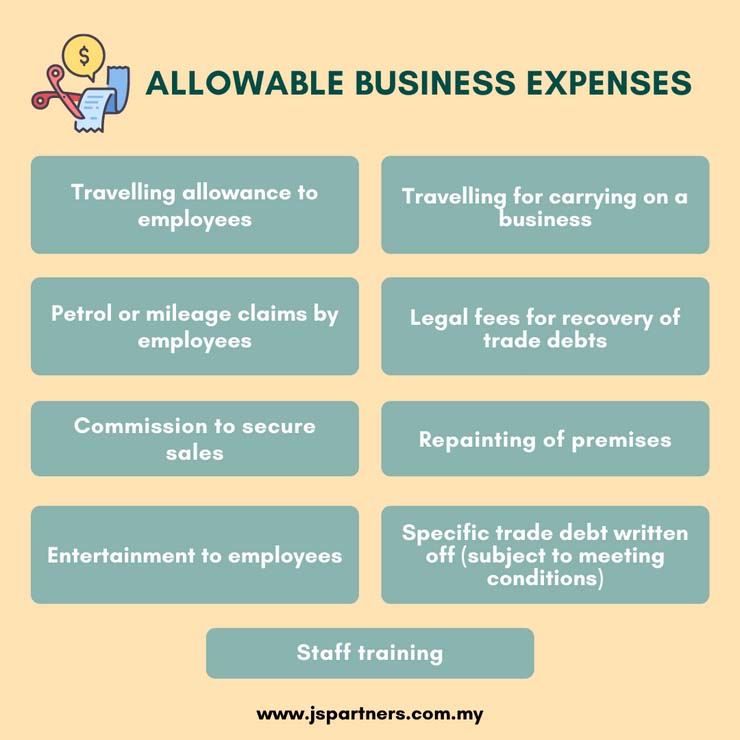

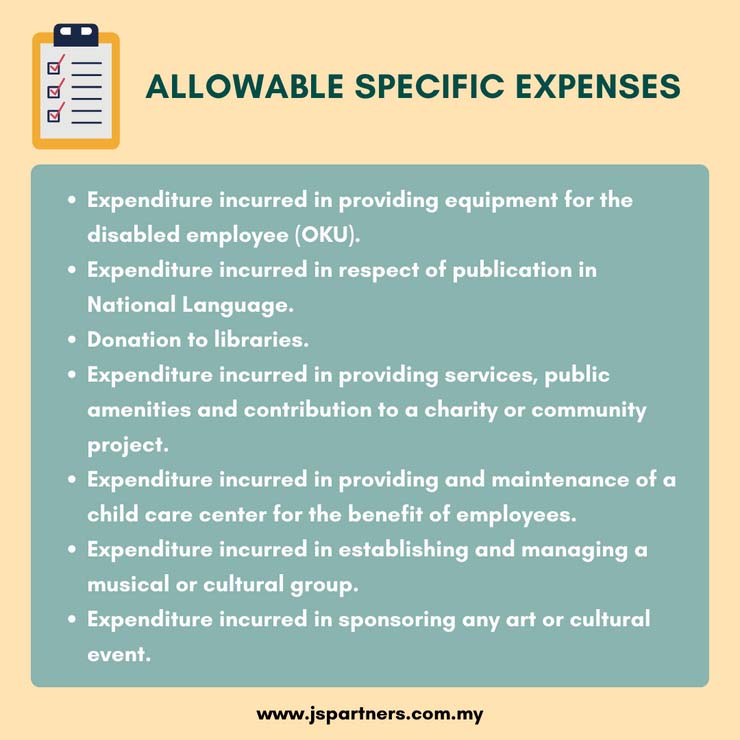

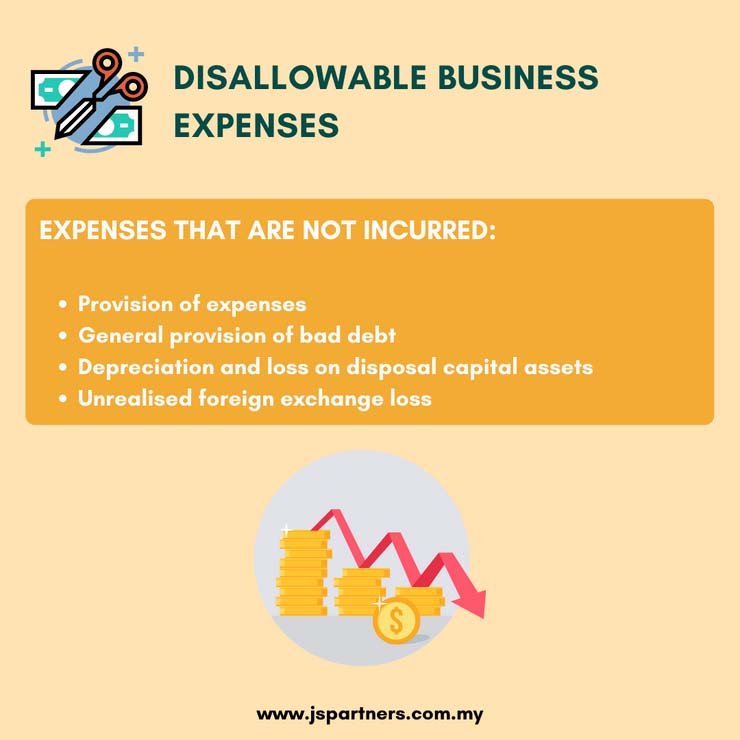

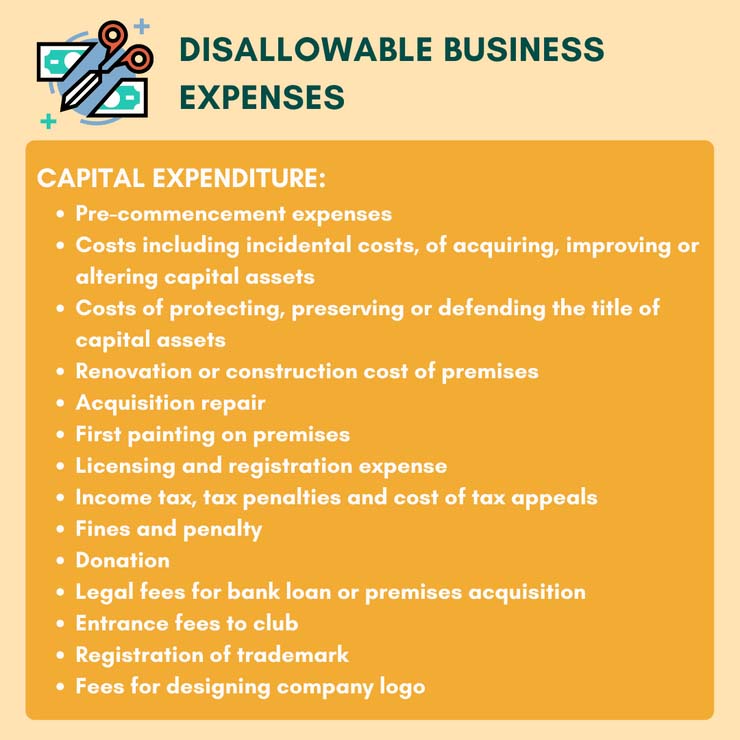

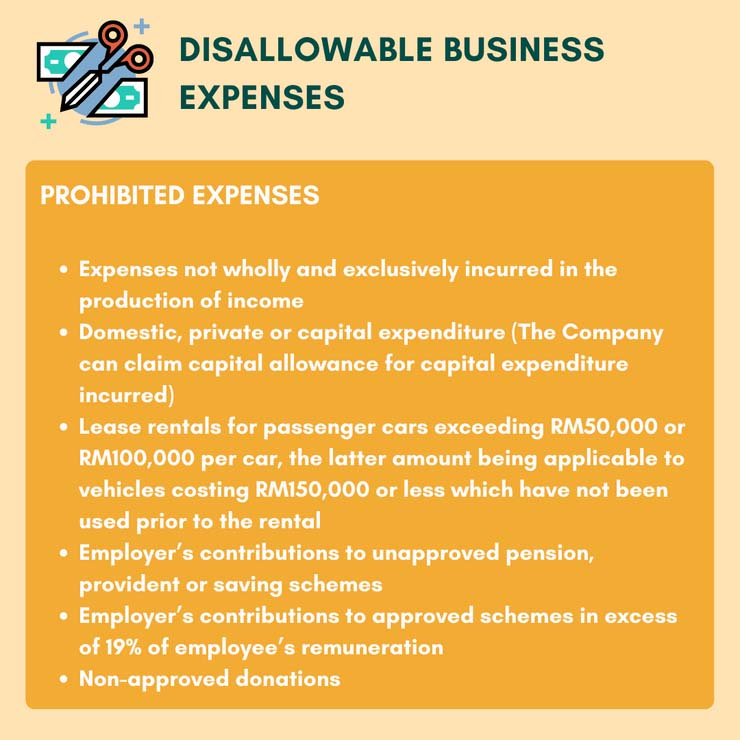

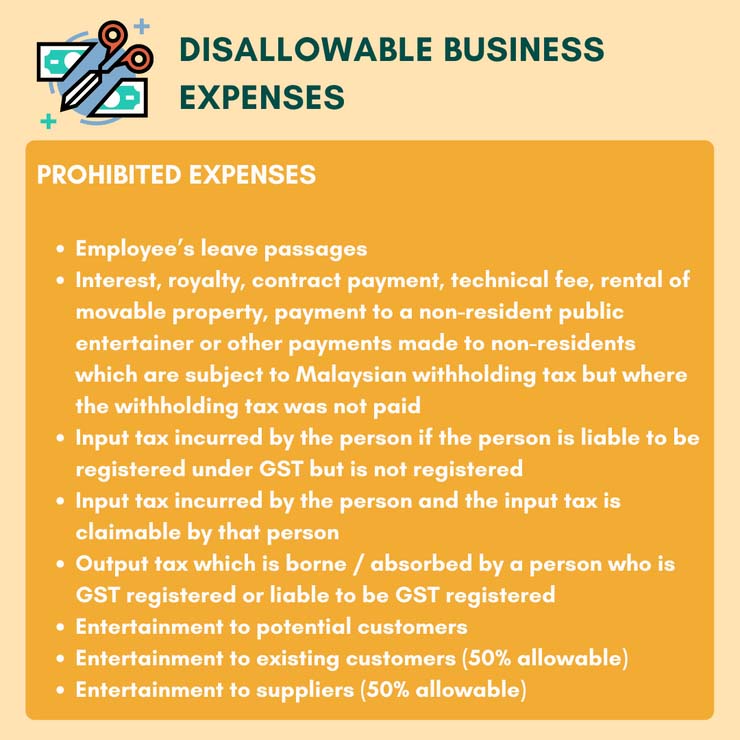

It is important to know that not all expenses in your accounting books can be allowed for tax deductions.

Allowable expenses are costs that are essential to running your business but does not include money used to pay for personal purchases. If an expense is not “wholly and exclusively” used for business purposes, then it is considered a disallowable expense and can’t be claimed as a deduction to lower the taxable income.

Still have questions? Reach out to us via WhatsApp at https://wa.me/60143248237.

Facebook: https://www.facebook.com/JS-Partners-890552254344978/

LinkedIn: https://www.linkedin.com/company/js-partners/